Excerpt from the Dayton Daily News

From 2012 through 2015, Wright State University administrators presented budget documents to trustees that projected a blossoming financial future.

At least three times in the fiscal year 2015 budget proposal, the university’s chief finance officer referred to the school’s finances as “strong.”

But a Dayton Daily News examination of financial data from the university found that it was losing millions of dollars a year even while pitching rosy forecasts to board members.

Two of those board members now acknowledge they were unaware of how much red ink was being hemorrhaged by the university.

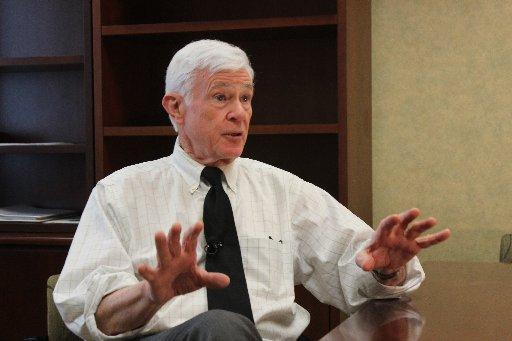

“I’m going to let the data speak for itself,” said Michael Bridges, the current chairman of the board. “It was not our understanding that (overspending) was an issue until May or June of 2016.”

Yet Wright State spent more money than it brought in for five straight years, from 2012 to 2016, and it is expected to run a deficit again this year.

The newspaper’s examination, which included 17 years of financial data, shows the university’s finances were in sound condition until fiscal year 2o12, after which point the school began draining reserve funds to cover expenditures.

From 2012 to 2014, Wright State overspent by a combined $20.7 million, according to financial statements from the Ohio Department of Higher Education.

Yet few alarm bells apparently went off.

“In FY 2015 Wright State University maintains its strong fiscal condition!” said a budget proposal to the board that year.

“There’s no doubt there’s an excessively rosy outlook in those budget proposals,” said Doug Fecher, vice chairman of the board of trustees and chairman of the board’s finance committee. Fecher began his term as a trustee in July 2014.

The overspending would eventually balloon to $34.9 million in fiscal year 2016, according to financial statements. In the current fiscal year, the university is expected to overspend by nearly $40 million, according to the university.

Those numbers bring to more than $120 million the amount of spending that has exceeded revenues over a six-year period.

Wright State is now faced with the need to cut $25 million from its next budget in order to balance its books. The school is also aiming to boost its unrestricted reserves by $5 million after that fund dropped from more than $100 million in 2012 to $12.9 million as of June.

WSU officials say they will be forced to implement budget cuts immediately. Layoffs, salary reductions and the elimination of the university’s golf team are all on the table, interim president Curtis McCray said last week.

Wright State laid off 23 employees in October and has been looking for additional ways to generate revenue, such as boosting enrollment or selling off the operation of its parking lots for a quick cash injection.

The years of overspending raise questions about why the university’s budget was not corrected sooner and how administrators and trustees missed the warning signs of a growing financial crisis.

Fecher acknowledged mistakes were made.

“The fact of the matter is that adjustments need to be taken immediately,” he said. “They’re adjustments from the last three or four years and if they had been made they wouldn’t have to be as severe now.”

‘By definition, they’re failing’

More than one year of overspending should have alerted the board of trustees and the administration, said Richard Vedder, an Ohio University economist who is an expert on college affordability.

Multiple years of that same pattern should have caused officials to “start screaming,” he said, or at least cause discussion of how the university would sustain itself.

“If overall expenditures are greater than overall revenues, by definition they’re failing,” Vedder said. “The fact is that if you spend more than you take in you have lost.”

Yet the annual budget proposals did not explicitly focus on the trend that was beginning to emerge. The fiscal year 2015 proposal boasted that the university’s assets had increased by more than $101 million between 2003 and 2013. It did not call attention to the losses.

Mark Polatajko served as Wright State’s vice president for business and fiscal affairs beginning in 2012. Wright State lost money every year Polatajko was in his position yet the language used in budgets prepared by his office are mostly positive.

Trustees stopped short of saying they felt Polatajko misled the board, but they said trustees received little warning of overspending. Polatajko, who left the university in 2016 and now serves as senior vice president for finance and administration at Kent State University, could not be reached to comment.

Ohio ranks the overall financial health of its public universities on a 0 to 5 scale. Any school that falls beneath 1.75 two years in a row is placed on “fiscal watch,” as Central State University was in 2014.

In fiscal year 2015, Polatajko’s office predicted Wright State’s score would increase from 3.4 to 4.0, one point off the top of the scale. Instead, the ranking dropped to 2.4 as the university overspent by more than $25 million. The most recent score, from fiscal year 2016, gave WSU a rating of 2.1, according to the state.

It’s obvious now, Bridges said, that the positive rhetoric “doesn’t align” with Wright State’s financial reality. Both Bridges and Fecher credited Jeff Ulliman, current vice president of business and finance, for bringing the budget issues to their attention.

Bridges also questioned why then-president David Hopkins did not make it clearer to the board that the university had overspent by millions.

“It is clear we were not getting the information in a quality and timely manner,” Bridges said.

Hopkins could not be reached to comment.

Was everyone ‘asleep?’

Administrators and trustees may have “fallen asleep” as Wright State’s budget descended into critical condition, McCray said.

Wright State had only overspent once from 2000 to 2011, according to financial statements. WSU overspent by $3.4 million in 2009 and not again until 2012.