Loan Repayment and Consolidation

On this page:

Federal Direct Loans

Direct Loans are federally subsidized and unsubsidized loans where the lender is the federal government. These loans are serviced by third-party vendors contracted by the federal government.

Understanding the repayment process for your federal student loans can go a long way toward building a solid financial foundation.

Remember, federal student loans are real loans, just like car loans or mortgages. You must repay a student loan even if your financial circumstances become difficult. Your student loans cannot be canceled because you didn't get the education or job you expected, or because you didn't complete your education (unless you couldn't complete your education because your school closed). To estimate your federal student loan payments, you may use the Loan Simulator provided by logging into your dashboard on www.studentaid.gov.

If you have any questions about your federal direct loans, contact Direct Loan borrower services at 1-800-848-0979 or visit the Federal Student Aid website.

You should also contact your loan servicer if you:

- Need help making your loan payment

- Change your name, address, or telephone number

- Have a question about your bill

- Graduate

- Drop below half-time enrollment

- Transfer to another school

- Stop going to school

- Have questions on deferment, forbearance, or loan consolidation

- Have questions on loan forgiveness, cancelation, and discharge

- Have questions on how to resolve a dispute

- Need to understand the consequences of default

Loan Servicer Information

Who is my loan servicer for Federal Direct Loans?

Visit your dashboard on studentaid.gov to view information about all of the federal student loans you have received and to find contact information for the loan servicer or lender for your loans. You will need your Federal Student Aid ID to access your information.

Below is a partial list of federal loan servicers.

You can find your federal loan servicer by logging into studentaid.gov for more information.

Please note: Institutions that enter into an agreement with a potential student, student, or parent of a student regarding a Title IV, HEA loan are required to inform the student or parent that the loan will be submitted to the National Student Loan Data System (NSLDS), and will be accessible by guaranty agencies, lenders, and institutions determined to be authorized users of the data system.

Exit Counseling

Prior to entering repayment, Wright State University will make Exit Loan Counseling available to student loan borrowers meeting one the following criteria via their Wright State e-mail account and/or via mail.

- Applied for graduation;

- Dropped to less than half-time enrollment for a term;

- Withdrawn from classes for a term; or

- Did not enroll for a term (excluding summer semester)

Exit Loan Counseling is designed to help students understand their rights and responsibilities as a borrower and to help determine an appropriate repayment plan. Borrowers may complete Exit Loan Counseling online at www.studentaid.gov. For additional information regarding what is provided by loan servicers prior to entering repayment, please visit our Borrower Rights and Responsibilities page.

Federal Student Loan Repayment Support

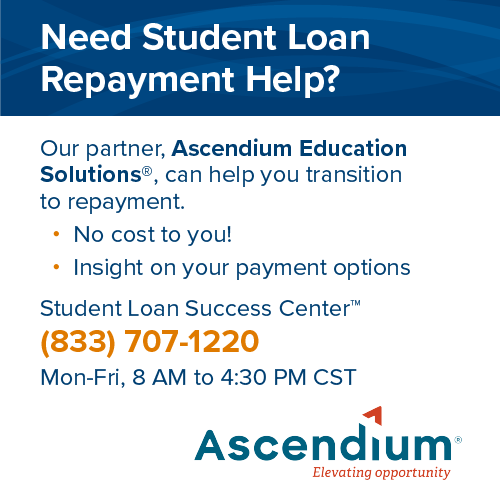

Wright State University has partnered with Ascendium Education Solutions® and its Repayment Support team. They can answer your federal student loan questions and help you find and implement an affordable repayment plan.

Because there are numerous scams and fraudsters taking advantage of students, we want to make sure you know Ascendium is a trusted resource for you. We hired them to reach out to our students to help them manage repayment. There’s absolutely no cost to you, and you can confidently talk with them to get help.

If you have questions or concerns about repaying your federal student loans, contact Ascendium's Student Loan Success Center at 833-707-1220 Monday through Friday, 9 a.m.–5:30 p.m. EST or by email at wrightstate@ascendiumeducation.org.

Federal Student Loan Consolidation

Borrowers can consolidate (combine) multiple federal student loans with various repayment schedules into one loan, making a single monthly payment. With a consolidation loan, your monthly payment might be lower, you can take longer to repay, and you will receive a fixed interest rate on your consolidated loan (based upon a weighted average of the interest rates on all the loans you consolidate).

Carefully review your consolidation options before you apply. Things to consider are:

- Whether you'll lose any borrower benefits if you consolidate, such as interest rate discounts or principal rebates, as these benefits can significantly reduce the cost of repaying your loans;

- Whether you might lose some discharge and cancelation benefits if you include a Federal Perkins Loan in your consolidation; and

- Whether consolidation will increase the total cost of repaying your loans. Because you may have a longer period of time to repay, you'll pay more interest.

Generally, you can consolidate:

- After you graduate.

- After you leave school.

- After you drop below half-time enrollment.

You can apply for a consolidation loan online or learn more about loan consolidation at Studentaid.gov.

Campus-Based Loans

The Student Loan Collection Department is responsible for servicing these and other institutional-based loans where Wright State University is the lender. We can be found within the Office of the Bursar and can be reached by phone at 937-775-5666 or by email at wsubursar-studentcollections@wright.edu. It is important for you to contact us throughout your loan repayment period whenever you:

- Change your name

- Change address

- Change telephone number

You can manage your Wright State campus based loan at heartland.ecsi.net; Wright State's school code is "w58".

Payments

Heartland ECSI is the billing service retained by Wright State to perform the billing and bookkeeping functions on our student loans. Heartland ECSI will email regular billing statements to the borrower.

Payments may be made by check and mailed to Heartland ECSI, via ACH payment from your checking or savings account, or debit card .

To make a payment electronically or set up a recurring ACH payments go to heartland.ecsi.net; Wright State's school code is "w58".

General Payment Information

- You may make payments in excess of the amount due without penalty.

- You must contact WSU Student Loan Collections if a payment will be late for any reason.

- You must inform WSU and Heartland ECSI of any changes in your name, address, or phone number.

- You may be eligible to defer, postpone or cancel repayment of your loan. Examine your loan paperwork to determine your eligibility. You will be required to complete a form and submit it in a timely manner.

- Your payment history will be reported to the credit bureau on a monthly basis.

- Your loan must be repaid on a timely basis.

- If you default on your loan, you may: (1) have a hold placed on your student account which will prevent registration and transcript release; (2) be subject to late fees on past due payments; (3) lose your right to defer or cancel the loan; (4) be required to pay collection costs once the account is certified to the Ohio Attorney General; (5) be subject to litigation.

Visit the Loan Repayment webpage to learn more.

Alternative (Private) Loans

For repayment information on your private loan, contact the alternative lender from which you borrowed your alternative loan. Please refer to your loan documents for contact information.

Understanding the repayment process for alternative (private) loans can help you maintain your financial health.

FASTChoice provides helpful information on staying on top of your loans, knowing your repayment options, and loan consolidation.