Chapter 8: Grants Ledger Queries

Quick Links

On this page:

Overview

- Grants are used within Finance to group accounting periods differently than the university fiscal year of July through June.

- Some 6xxxxx sponsored programs through RSP may span multiple years or have a fiscal year of Oct through Sept, e.g.

- Some 8xxxxx plant funds and 995xxx state-related agency funds may also span multiple years.

- WINGS Express Finance offers the ability to view data by the Grant Year.

Special Sponsored Program Grant Issues

- Sponsored Program grants have codes 6xxxxx and are administered by the Office of Research & Sponsored Programs.

- Each grant code may have 1 or more related fund codes, which also are 6xxxxx. A different fund number may be assigned for various reasons including

- a co-PI that is to monitor their assigned budget.

- a definite start & end date.

- a change in PI and the org will be different.

- Research Challenge grants.

- House Bill grants.

- a change in F&A rate.

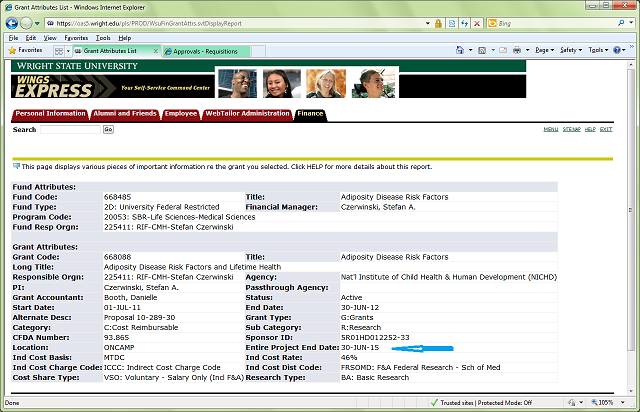

- The Grant Attributes link displays various pieces of information about these grants - including start & end dates, the name of the grants accountant to contact, whether cost-share is required, the default org & program codes, etc. Enlarge the screenshot at the right to see sample output for a specific grant. The Grants Accountant assigned to your grant is your first point of contact for questions.

- When querying WINGS Express Finance for 6xxxxx grants or funds, do not include revenue accounts (5xxxxx). RSP inputs budget equal to the amount of revenue per the award so that you do not need to include revenue.

- Account 799000 Facilities & Admin (F&A) costs is unique to 6xxxxx funds, and the amount of this charge is based on the grant award document. Updates to this account are made nightly. F&A represent expenses that benefit the grant/contract funded activities but are of such a nature that it would not be practical or cost-effective to try to calculate what the actual benefit is to the particular projects. Typical expenses include maintenance, building depreciation, library costs, & administrative functions (e.g. purchasing, payroll, RSP) that are employed indirectly to support research and scholarly efforts. F&A costs are reimbursed through one or more rates negotiated with the federal government & then typically applied as a percentage of most of the direct costs incurred on particular projects.

- If there are any expenses being cost shared (i.e. WSU is paying the costs for the project instead of the sponsor) then the corresponding Activity Code must be included in the FOAPAL used on Journal Vouchers, Invoices, Salaries, Travel, & any other types of expenses being cost-shared. The Program Code used on these transactions should match the program code of the 6xxxxx being cost-shared.

- Please see the RSP website at RSP Info for additional information.

Grant Attributes Query

Query

- The Query Budget and Transaction Detail Query include an input box for the Grant code. When you input a grant code, the output will include Grant-to-Date (GTD) amounts. This means that the figures displayed are the cumulative amounts since inception of the particular grant queried.

- For 6xxxxx sponsored program grants administered through RSP, do not include revenue in your query.

- If you input the 6xxxxx code into the fund field, only the university fiscal year-to-date amounts will appear. It is recommended that the grant field be used for grants to ensure that all transactions are captured.

- To see all fund amounts (to which you have access) for a given grant, type a % into the fund field and type the grant code into the grant field.

- To see a specific fund in a given grant, type that fund code into the fund field and the grant code into the grant field.

- The Balance Available Report will pull information from the grant ledger, where there is a grant related to the fund selected. It will not include revenue for 6xxxxx sponsored programs. The Balance Available Report displays expenses in subtotals rather than by individual data-enterable account code.

- Using the Index field for inputs into WINGS Express Finance, especially when creating documents, will help ensure that the correct organization and program codes are used with the 6xxxxx fund code.

- Accounted Budget represents the current budget approved by the sponsor.

- From Query Budget, if you drill down to the transactions - be aware that the transactions will include all since the grant's inception (not just those as of a particular fiscal year & period for which you initially ran Query Budget.

Journal Vouchers

Journal Vouchers (JVs) charging 6xxxxx funds need to include this information in the document text:

- transaction date of the original expense

- Banner document code of the original expense (for example, invoice number or travel authorization number)

- vendor or supplier name for the original expense

- description of the expense

- dollar amount of the expense, if there is more than one expense being transferred on the same JV

- grant purpose to move the expense to the grant (how the expense benefits the grant/fund)

- for procard expense transfers, attach a copy of the procard statement and the backup documentation to the JV

Providing this information will generally allow anyone viewing the JV to locate the source of the expense being transferred in WINGS Express Finance. Please use the JJCOSTTR Jumpstart JV to ensure that the document text includes all the required information. Please see Chapter 4 for additional details.